Supply of goods in times of crisis: analysis and lessons for Switzerland

- Introduction Executive summary | Positions of economiesuisse

- Chapter 1 A differentiated analysis despite an ongoing crisis

- Chapter 2 Security of supply does not equal self-sufficiency

- Chapter 3 Switzerland as an import nation strengthens security of supply

- Chapter 4 Security of supply in the COVID-19 crisis

- Chapter 5 Lessons from the crisis: proposals from economiesuisse

Security of supply in the COVID-19 crisis

With regard to the issue of supply, the COVID-19 crisis can be divided into two distinct phases:

Acute pandemic phase (from spring until end of 2020): due to the rapid spread of the coronavirus, the demand for goods to fight the pandemic skyrocketed. This led to shortages of products such as medical masks and disinfectants in many countries. Calls for greater self-sufficiency have followed in many countries. In Switzerland, too, there have been calls for certain production capacities to be relocated domestically.

Recovery phase (from spring 2021 to present): thanks to a global vaccination campaign and expansion in the production of medical goods, the epidemiological and therefore also the economic situation have recovered. However, disruptions in global supply chains have been accentuated. An unexpectedly strong increase in demand since last autumn is currently creating a tense situation in logistics. Various raw materials, intermediate products and industrial goods are being affected. A rapid easing of this challenging situation is not in sight.

Acute pandemic phase: temporary shortage of goods to fight the pandemic

Triggered by the COVID-19 pandemic, the global economy fell into a deep recession in the spring of 2020. Government-imposed closures of production facilities and export restrictions also had a severe impact on certain Swiss imports. In the second quarter of 2020, imports recorded a seasonally adjusted decline of 16 percent compared to the previous quarter – the sharpest drop in decades.

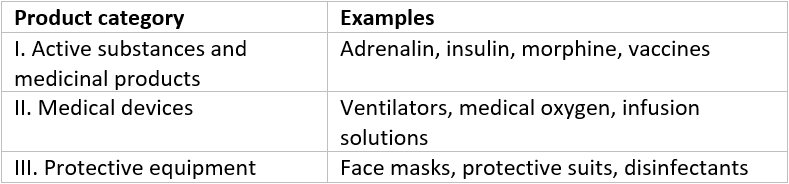

During this acute pandemic phase, public interest was particularly focused on goods for the prevention and control of the pandemic. A list of such ‘important medicinal products’ is provided by the COVID-19 Ordinance 2 of 13 March 2020, which divides them into three categories:

Although Switzerland did not experience any persistent supply bottlenecks, the supply situation for some of these goods was tight for several weeks.

I. Active substances and medicinal products

From February 2020 onwards, the FONES reported a temporary sharp increase in reports of supply disruptions on the therapeutic products reporting platform. More than a third of the reports from 2020 concerned antibiotics (33%), but antifungals (14%), analgesics (12%) and muscle relaxants (4%) were also mentioned. The reason most often given for the shortage was the increasing global demand. The data also show that the situation returned to normal after a short time (April 2020).

II. Medical devices

While medical oxygen was always available, steel cylinders were in short supply at times. Therefore, the Swiss Agency for Therapeutic Products (Swissmedic) temporarily permitted the use of other technically suitable tanks. In the case of respiratory equipment, the supply could always be guaranteed despite strongly growing demand; only individual components were in short supply at times.

III. Protective equipment

The demand for disinfectants increased sharply over a short period of time, resulting in a shortage of ethanol in particular. To counteract this shortage, the Federal Office of Public Health (FOPH) issued a temporary exemption permit for locally produced ethanol. In the longer term, the re-introduction of a compulsory stockpiling of ethanol is planned (see ‘Lessons from the crisis’ below).

There was also a temporary shortage of face masks. As with the active substances, Switzerland is heavily dependent on imports (around 80 per cent of mask imports come from China). As global demand increased massively in a very short time in March 2020, Switzerland had to procure masks in a tight market. In addition, various states temporarily blocked the export of medical protective equipment to Switzerland. This also included some EU member states.

Focus: The value chain of face masks

Face masks are inexpensive and disposable items. It is easy to forget that their production involves various raw materials and sometimes relatively demanding manufacturing steps (see following diagram). This includes, in particular, the production of the filter fleece in the so-called ‘melt-blown’ process.

This very process has been identified by the OECD as the most important bottleneck in the production of face masks. This is due to high initial investments in production facilities, which mean that the process can only be carried out by a limited number of companies. This also explains why, in the acute pandemic phase, many countries found it difficult to quickly increase the supply of protective masks.

Case #2: Face mask production in Switzerland

At the beginning of the pandemic, the prices for face masks exploded – in Switzerland people were paying up to ten Swiss francs per piece at the time. This prompted several Swiss companies to import machines from China in order to produce masks themselves.

However, almost a year and a half later, many Swiss mask producers have become disillusioned. They encountered difficulties already at an early stage, in some cases during the procurement and commissioning of the machines. In addition, foreign manufacturers have been able to expand their production capacities and prices have fallen. As a result, some companies had to reduce their production again due to lack of demand, and others had to discontinue it altogether.

Cilander AG also started manufacturing Community masks in May 2020. Despite the challenges, government acceptance guarantees are not an issue for the company: ‘We do not believe that the laws of the market can be overridden with government requirements,’ says CEO Burghard Schneider. ‘Switzerland must instead focus on those areas in which certified precision and highest quality count’.

Myths and Facts

Myth I: The COVID-19 crisis has exposed nationwide supply gaps in Switzerland.

Facts: despite shutdowns, delivery delays and export restrictions imposed by various countries, Switzerland did not experience any widespread and persistent supply bottlenecks. This is also confirmed by the Federal Council in its Foreign Economic Policy Report 2020. Thanks to diversified supply chains, sensible legal requirements (e.g. compulsory stocks), as well as close cooperation between the private sector and the authorities, the situation remained under control.

Switzerland was able to react quickly to the temporarily tense supply situation for medical protective material and active ingredients. Nevertheless, the resilience of the value chains should be strengthened with forward-looking measures(see ‘Lessons from the crisis’ below).

Myth II: Trade restrictions are the most effective means of ensuring security of supply in Switzerland.

Facts: in the acute pandemic phase, many governments decided to impose export restrictions on medicines and protective materials in order to meet domestic demand. However, these measures are by no means an effective means of strengthening security of supply:

- Countermeasures by other trading partners can lead to a negative trade policy spiral. Precisely those primary materials that a country needs for its own production (e.g. substances for manufacturing medicines) could be affected. This causes international supply chains to falter.

- Export restrictions reduce supply on the world market, with a corresponding impact on prices. For example, the wave of export restrictions in 2020 increased the cost of medical supplies by an average of 23%, and the cost of protective masks by as much as 40%.

- Export bans do not encourage an expansion of production capacity. Due to economies of scale, a company may even have less incentive to sell domestically if it is prevented from exporting.

Global trade will therefore remain the basis of stable supply systems in the future. Thanks to a high level of exports, numerous international companies maintain considerable production capacity in Switzerland – for example for food, pharmaceuticals, chemicals, and other industrial products. This is due to the favourable framework conditions for global exports, which has a positive impact on supply security.

Recovery phase: global challenges in transport and logistics

Since spring 2021, logistical problems in global supply chains have expanded and intensified. Transport on the world’s oceans is disrupted. Many consumers and companies around the world are waiting in vain for their goods to be delivered on time. Industry experts call it a ‘perfect storm’.

Where do the supply chain disruptions come from?

- In 2020, a production freeze in Asia and a global decline in demand led to the short-term withdrawal of around 550 container ships from the market.

- In 2021, global demand increased massively. At the same time, it shifted from services to private consumption (‘e-commerce’). As a result, demand for goods exceeded transport capacities for the first time in decades.

- On some routes, transport costs have increased by more than 500 per cent compared to the previous year. In many cases, this price increase is passed on to consumers.

- Containers are currently lacking on the most important trade route from Asia to Europe. This is because, among other things, medical equipment was transported to the southern hemisphere at the beginning of the pandemic.

- Port closures have led to congestion of countless container ships near the ports. In 2020, 65 percent of container ships were still running on time; in 2021, this figure dropped to 35 percent.

- Congestion at the ports shifted the problem to inland transport – aggravated by a lack of truck drivers.

- Due to the pandemic, there were repeated factory closures and corresponding production losses.

Uncertainty for Swiss companies

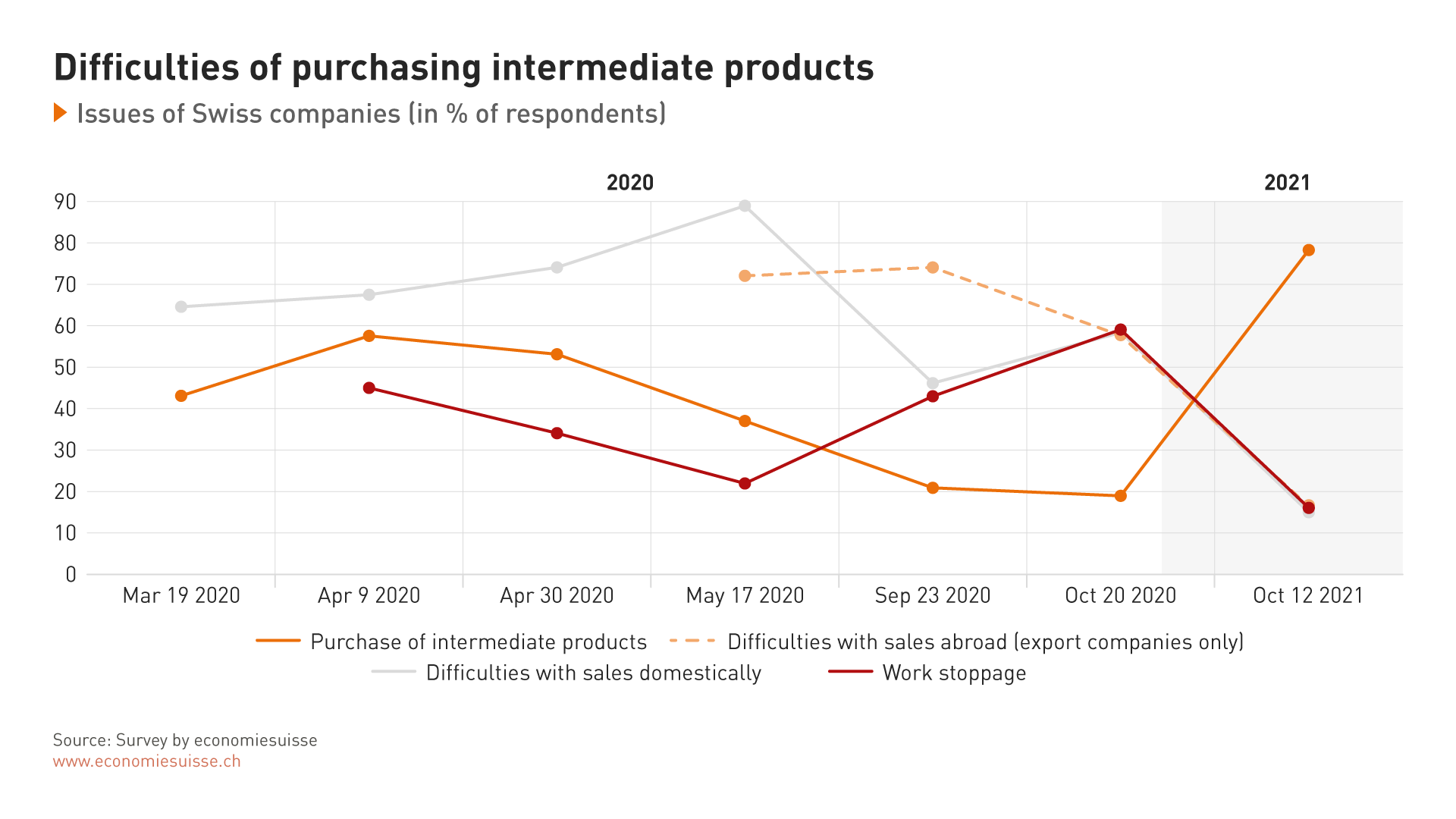

Many Swiss companies are currently affected by the supply chain disruptions. a rapid normalisation of this tense situation cannot be expected. This is shown by a survey conducted by economiesuisse involving 237 companies and associations in October 2021:

- A sales problem last year has meanwhile turned into a production problem. Four out of five companies report difficulties in sourcing input products. This proportion is significantly higher than during the acute phase of the pandemic last year (see chart below).

- The shortage of materials affects almost the entire industrial sector (including construction), but also trade. Raw materials (steel or wood), as well as intermediate products (computer chips) and end products (washing machines or cars) are in short supply.

- The supply bottlenecks for computer chips and semiconductors in particular are causing problems for numerous sectors. Medical technology, for example, currently lacks any planning security for procurement and production.

- The most frequently cited reason for delivery bottlenecks is problems with transport and logistics (72%). However, limited production capacities (68%) and production stoppages at suppliers (64%) are also cited.

- As a countermeasure, about two-thirds of the companies have increased their stocks, and about half of the companies are looking for additional suppliers.

- Likewise, about half of the companies have already been forced to raise prices. Three-fifths are planning this step within the next six months.

Myths and Facts

Myth III: Globalisation is a disadvantage for Switzerland’s security of supply.

Facts: there is no evidence that countries that are less globalised coped better with the COVID-19 crisis than more internationally connected economies. On the contrary, a study by the OECD from February 2021 shows that integration into global value chains plays an important role in cushioning economic shocks related to the COVID-19 pandemic. Countries that are less globalised are less exposed to such shocks but are also far less able to be cushioned by international trade.

This also applies to Switzerland. It is the cross-border networking of development, research and production which guarantees an unprecedented level of availability, diversity, and degree of innovation of critical goods and services at favourable prices in Switzerland. A decoupling from global value chains would have the opposite effect.

Myth IV: Switzerland needs to build up more production capacities at home in order to be able to respond better to supply chain bottlenecks.

Facts: the idea of division of labour is based on the logic that a country should specialise in the production of those goods for which it is relatively better equipped than others. Without massive state intervention and industrial policy, the complete production of critical supply goods in Switzerland thus makes no sense in an economic perspective

Moreover, even a European or Swiss manufacturer is dependent on inputs from abroad (e.g. chemical raw materials, yarns, plastics). It is therefore rather the geographical distribution that enables the economy to compensate for crises in certain regions by obtaining supplies from other markets. In other words, the distorted focus on final production does not solve the problem of a bottleneck, but merely shifts it along the value chain.

The fact that ‘re-shoring’ of production is also an illusory undertaking from an economic point of view is exemplified by the example of generic medicines:

- The importance of the international division of labour makes self-sufficient production for the small Swiss market impossible. Generics consist not only of active ingredients, but also require additives and fillers. The production of such substances in Switzerland is simply not profitable.

- Even with high-cost efficiency, the current market price of generics could not be maintained due to the high production costs in Switzerland. Due to ongoing price reductions, it is only possible to work profitably with low margins through large volumes.

- The existing production capacity in Switzerland is already largely utilised. Investment in new production facilities would be necessary, but this cannot be justified due to difficult economic prospects.

- If at all, production capacity should be addressed continentally and in a coordinated manner with several states.

Focus: The development of a COVID-19 vaccine

The development and production of vaccines are very complex and time-consuming processes. It is therefore all the more remarkable that several vaccines to protect against the coronavirus could be developed and approved within a very short time. What usually takes the pharmaceutical industry several years was achieved in just one year. In addition to accelerated approval procedures by the drug authorities, international cooperation in the areas of research, development, testing, and production was essential to achieve this result.

The place where an active ingredient is finally produced is of secondary importance for security of supply. National self-sufficiency for the production of vaccines is an illusion. Politically motivated export restrictions on the distribution of vaccines have a destabilising effect in the fight against a pandemic. They frequently lead to countermeasures that can severely disrupt functioning supply chains.