Supply of goods in times of crisis: analysis and lessons for Switzerland

- Introduction Executive summary | Positions of economiesuisse

- Chapter 1 A differentiated analysis despite an ongoing crisis

- Chapter 2 Security of supply does not equal self-sufficiency

- Chapter 3 Switzerland as an import nation strengthens security of supply

- Chapter 4 Security of supply in the COVID-19 crisis

- Chapter 5 Lessons from the crisis: proposals from economiesuisse

Switzerland as an import nation strengthens security of supply

It is well known that Switzerland is one of the world’s strongest exporters. However, in the context of security of supply, a precise knowledge of the Swiss import structure is also helpful. Optimal access to foreign procurement markets is essential for Switzerland with its small domestic market and lack of raw materials.

Switzerland’s imports of goods in 2020

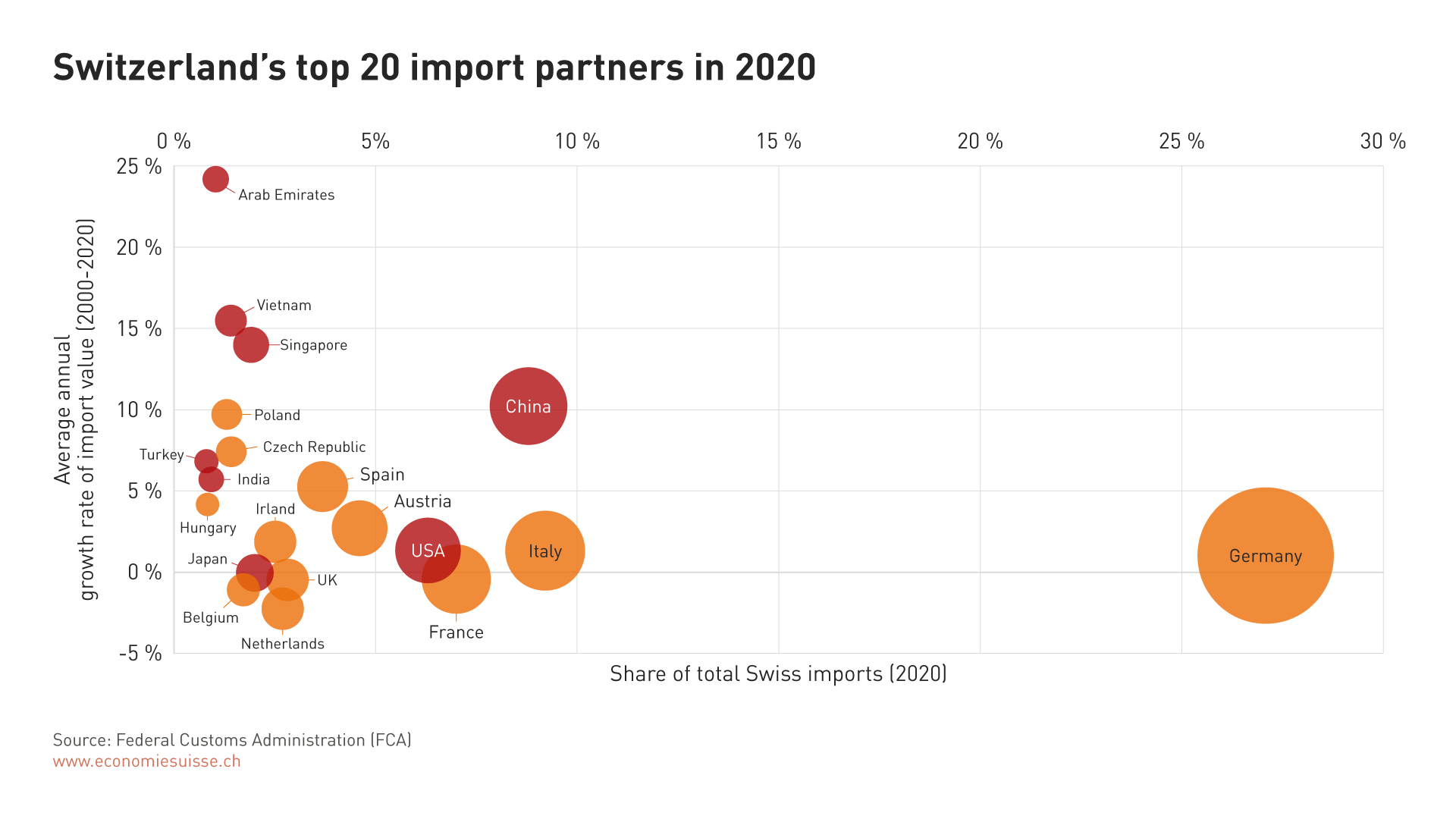

- The illustration of Switzerland’s top 20 import partners in 2020 (see chart below) reveals its close integration with Europe: of the ten largest import partners, eight are European countries (orange bubbles). This situation is facilitated by geographical proximity and largely non-discriminatory access to the EU internal market.

- The two non-European countries (red bubbles) in the top 10 are the USA and China. The latter was able to record a relatively high average annual growth rate in imports of around 10 per cent between 2000 and 2020.

- Switzerland can also draw on a diversified network with countries from Asia or the Middle East. The Arab Emirates, Vietnam, and Singapore, for example, have the highest annual growth rates of all the top 20 importing countries.

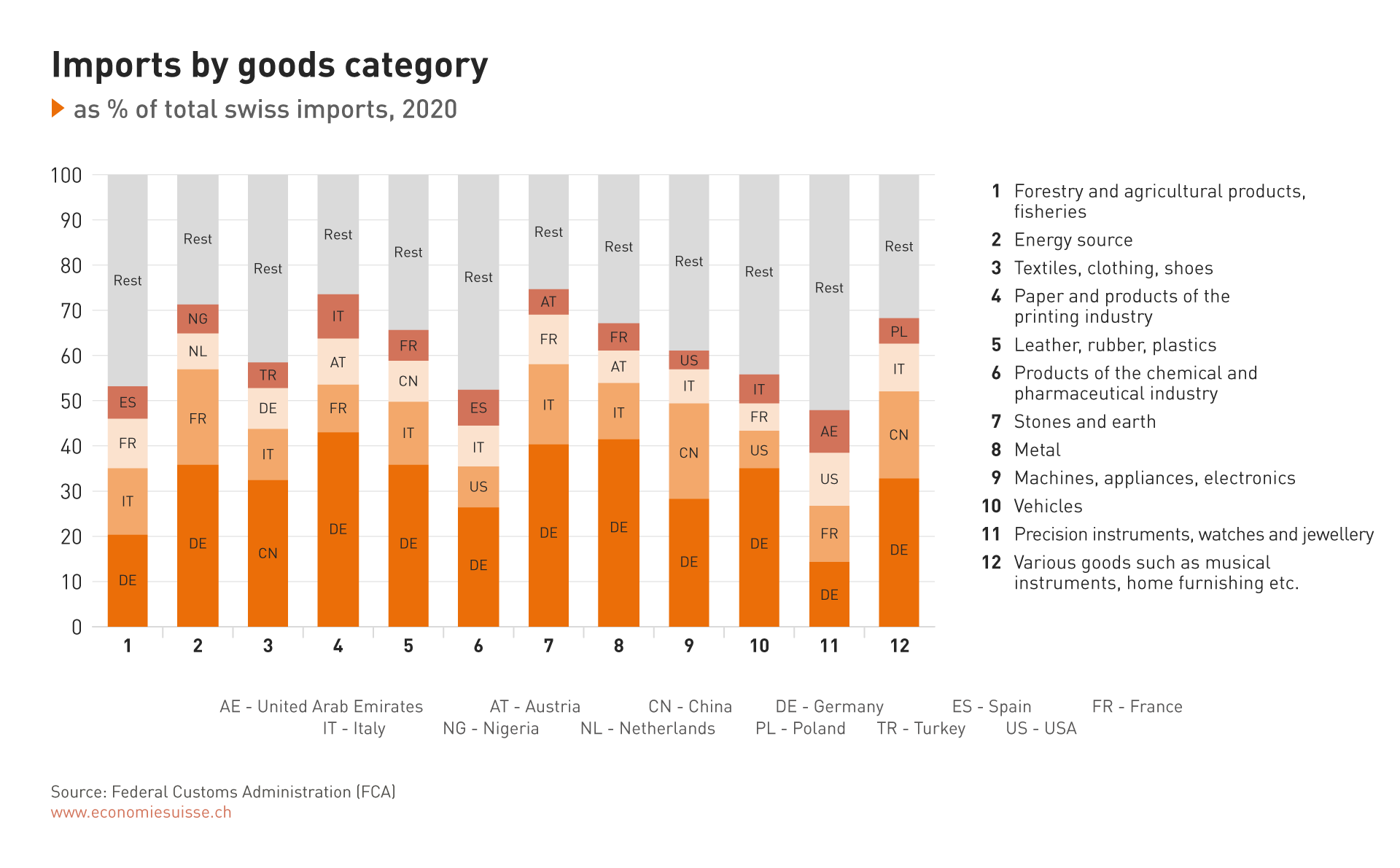

- Switzerland’s close ties with its neighbouring countries are also reflected in the individual product categories: Germany is the largest import partner in eleven out of twelve categories (exception: China is the largest import country in the category of textiles, clothing and footwear). In addition, Italy or France are the second largest import partners in eight out of twelve categories.

- At 52 per cent, the cumulative share of the top four importing countries is second lowest for chemical and pharmaceutical products (after watches and jewellery).

Case #1: Bucher Industries – decentralised procurement strategy creates flexibility

Bucher Industries, based in the canton of Zurich, serves as a prime example of a company that successfully holds its own in the market thanks to a highly diversified procurement structure. The conglomerate specialising in mechanical and vehicle engineering has a highly decentralised organisation compared to its competitors. Most of the more than 50 locations worldwide have their own suppliers – more than 14,000 in total. ‘Proximity to suppliers is a key advantage for us. It gives us greater stability in procurement and enables us to react more flexibly in the event of bottlenecks,’ explains Jacques Sanche, CEO of Bucher Industries.