Brexit: a “moving target” for the Swiss business sector too

- Introduction Executive summary | Positions of economiesuisse

- Chapter 1 Mixed picture for trade after Brexit

- Chapter 2 Brexit – status of the withdrawal process

- Chapter 3 Ongoing uncertainty for Swiss companies

- Chapter 4 Potential risks for businesses

- Chapter 5 Political priorities from the point of view of the Swiss business sector

Potential risks for businesses

In the context of Brexit it will be necessary to find new contractual solutions for various aspects of cross-border trade and access to the UK market. This applies to trade in goods and services as well as to investment activities. Depending on the final form of these solutions, Swiss businesses may find themselves confronted with new barriers to trade in Europe. The impacts may extend to the unbureaucratic and timely availability of personnel, calculation of production and delivery costs, processes associated with product certification, legal requirements concerning the physical presence of Swiss companies in the UK, and cross-border data flow.

Figure 7

Brexit and small and medium-sized companies: preparing to adapt to a moving target

In view of the considerable uncertainties associated with Brexit, it is currently unclear which scenario, and thus which problems, will in fact arise for Swiss companies, and when. In addition, the impacts for each company will be different, depending on the sector, the company’s size and its connections with the UK. From today’s perspective, the only assumption that can be made is that the UK will abide by its fundamental decision to exit the EU.

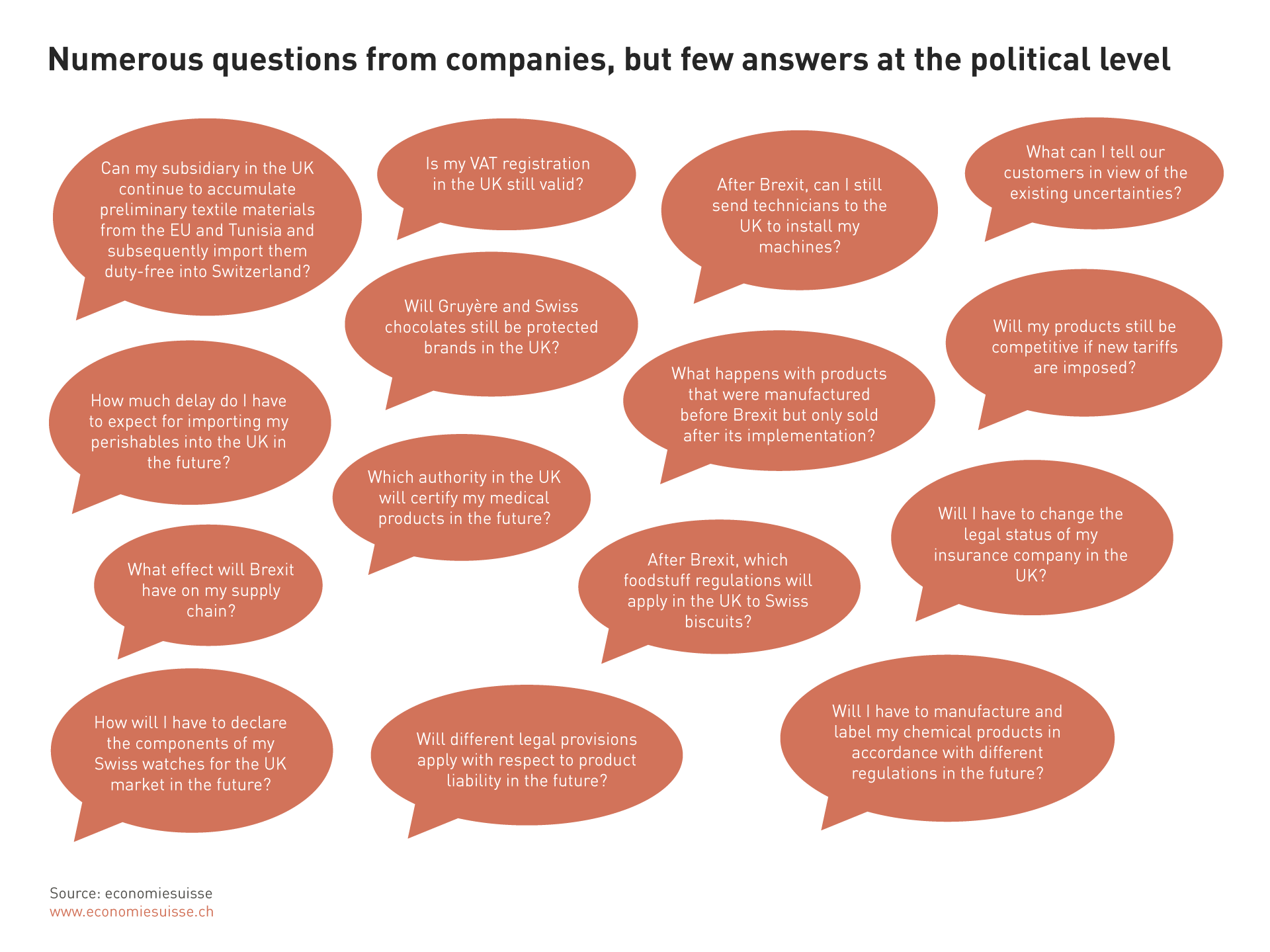

Given these overlying issues in connection with Brexit, Swiss companies are currently facing a multitude of concrete problems in their everyday business that makes their long-term planning more difficult.

Figure 8

Despite this lack of clarity, companies must keep their eye on this moving target and take the best possible business decisions they can in good time and prepare themselves for the worst-case scenario. It could be helpful to consider the following steps and questions:

1. Where do we stand?

Involvement: To what extent does my company have economic ties with the UK? This question may apply to the entire range of operational functions (subsidiaries, supply chains, partnerships, regulation, logistics and data flows, tax formalities, personnel, etc.).

Organisation: Are the company’s internal units networked and is its management personnel involved as needed to prepare a comprehensive analysis and provide the appropriate information?

Network: Is it possible to draw on existing analyses by partner companies or industry associations? This could save time and costs.

2. Strategy

Scenarios: Which options for action does the company have for minimising the risks associated with Brexit and making use of new opportunities that may arise? In view of the prevailing uncertainty, it is advisable to plan on the basis of scenarios and introduce the necessary precautionary measures (e.g. alternative suppliers, deployment of personnel, licences, new markets) in good time in line with the probabilities of occurrence.

Reverse planning: Which measures have to be taken, and when, to be ready for Brexit by 29 March 2019? Which operational decisions need to be taken in this context? Not all options call for the same lead time; in other words, it is not possible to secure everything today and with an acceptable level of resource expenditure.

3. Monitoring

Keeping an eye on developments: Does the company have the information it needs to periodically review its strategic planning? In view of the tense nature of the Brexit negotiations, changes could take place at any time. Companies can monitor developments through economiesuisse, industry associations or external service providers.

Making use of opportunities: Does Brexit offer the option of addressing not only external opportunities, but also internal optimisation processes that until now have been considered to be of secondary importance? Adaptation of systems, supply contracts, cost models, etc., could have the potential to increase efficiency.